Insurance Commissioner Tim Temple says his department is working to establish a benchmark range on the discount a homeowner should receive on their property insurance for having a fortified roof. Temple says these benchmarks are being thoughtfully developed to help consumers receive the discounts they deserve for fortifying their homes.

“The Fortified Roof Program is very popular. And, for the last several years, there’s been a push to make a mandatory discount,” Temple said.

Temple says this Department of Insurance regulation would require Louisiana insurance companies to either meet the minimum benchmark, which could be as much as 20%, or provide actuarial justification for why the company’s discount does not meet the benchmark.

“This is to bring more certainty to homeowners trying to get the maximum discount that they can get. But at the same time, not force companies that may not be able to get there, to not write homes in our state,” Temple explained.

The Department of Insurance says it will provide further information soon on when the fortified roof benchmark discounts will go into effect. Temple says if you have a fortified roof and if you believe your homeowners insurance premium should be lower, shop around.

“There are more companies that want to write your home because it’s fortified. You don’t have to stick with that insurance company. Shop your insurance, as we say a lot,” Temple noted.

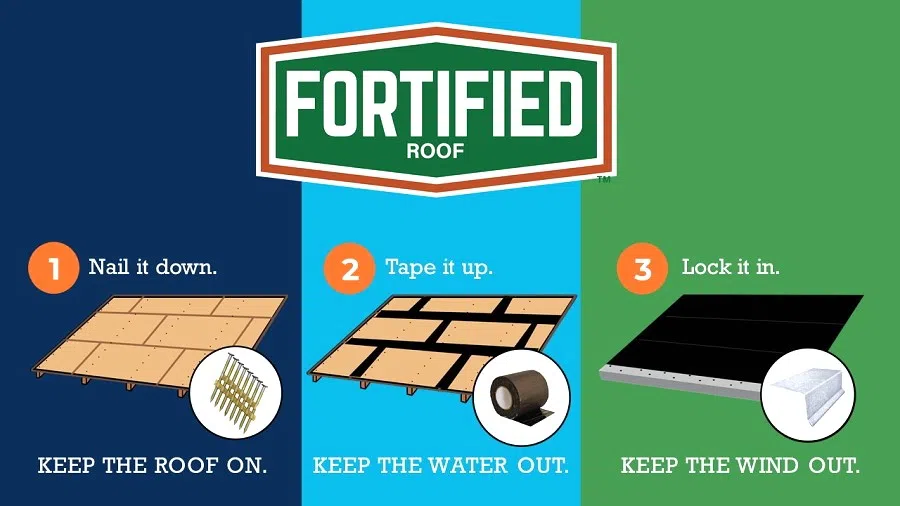

Louisiana is the fastest growing state for fortified roofs in America. To date, over 11,000 fortified roofs have been installed, including more than 4,100 through the Louisiana Fortify Homes Program.